The second quarter of 2023 saw 12 new products break into Amazon’s list of Top 25 Beauty & Personal Care Products, the most newness to hit the Top 25 in over two years. 75% of the new items were under $10, driving the average MSRP of the list from $13.78 in Q1 2023 to $10.78, a 22% decline and the lowest in years, as the demand for price-inclusive beauty on Amazon grows.

Last quarter, CosRX Snail Mucin Essence debuted on the Top 25 List #20. This quarter, after over 375 million views of #snailmucin on TikTok, they’ve jumped to the #2 spot, displacing perennial favorite Mighty Patch Original Pimple Patches, which has held the spot for much of the past two years. In Q2, Mighty Patch fell to an unprecedented #10, the lowest ranking for the product since we started reporting on the Top 25 List two and a half years ago. This might have something to do with increased competition in the market for hydrocolloid blemish solution products and Mighty Patch’s retail expansion at the likes of Target and Ulta. Regaining its #1 spot for the first time since Q2 of last year, Essence Lash Princess False Lash Effect Mascara displaced Mielle Rosemary Mint Scalp & Hair Strengthening Oil. Mielle took Amazon beauty by storm in Q4 of 2022 with its debut on the Top 25 List in the #1 spot after an appearance on TikTok influencer Alix Earle’s list of top 2022 Amazon purchases. The product maintained its #1 spot last quarter as the press regarding the brand’s acquisition by Procter & Gamble helped it maintain momentum. In Q2, Mielle remains one of the top beauty brands on Amazon, coming in at #3.

In Q2, the Top 25 List saw increased beauty category diversification toward the top of the list. Fragrance, mascara, and nail products found representation, including #4 Sol de Janeiro Cheirosa ’62 Hair & Body Fragrance Mist, #4 Pronto 100% Pure Acetone, #7 Maybelline Lash Sensational Sky High Washable Mascara, #8 L’Oréal Paris Voluminous Lash Paradise Mascara, and #13 Nautica Voyage EDT for Men. Nail brand Modelones had three products on the list, including summer nail shades like Bright Neon Orange and Summer Bright Yellow. These products joined Top 25 List mainstays like #10 Mighty Patch Original Pimple Patches and #11 Nizoral Anti Dandruff Shampoo.

This category diversification helped even the playing field across all of the beauty categories the Top 25 List tracks—makeup, skincare, body, hair, and tools—largely at the expense of skincare, which went from representing 48% of the list in Q1 to only 19% in Q2. Body, hair, and tools all saw meaningful increases.

Consistent with the trend toward price-inclusive beauty on Amazon, the top 10 skincare products on Amazon during Q2 largely consisted of mass favorites like CeraVe, comprising 40% of the list, Dove, PanOxyl, and Neutrogena. EltaMD UV Clear Face Sunscreen was the only truly prestige product on the Skincare Top 10 this quarter.

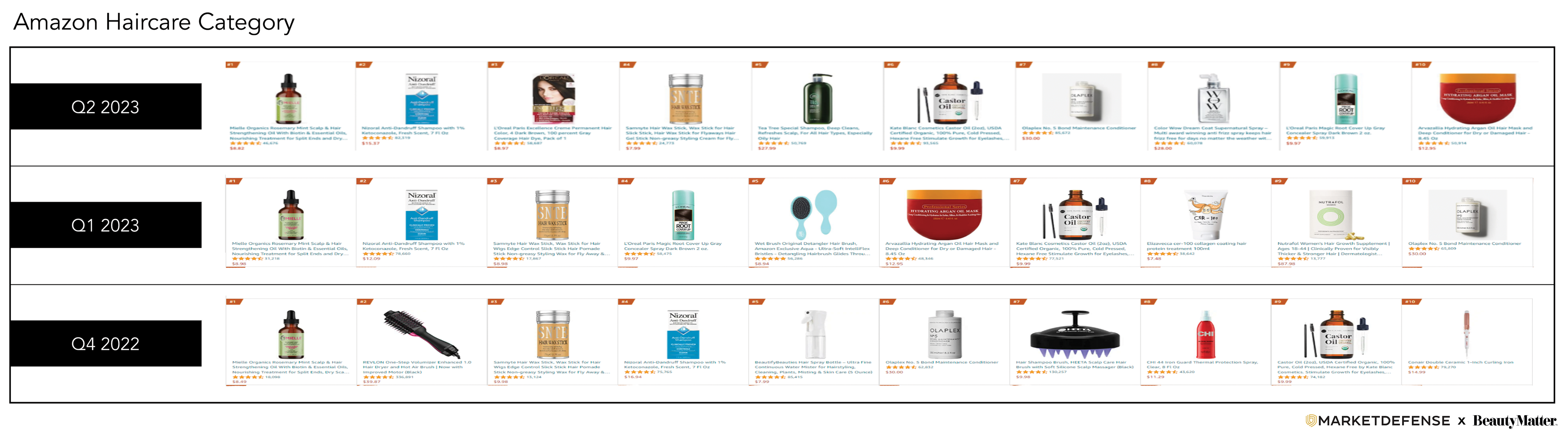

The Haircare Top 10 continued to be led by Mielle’s Rosemary Mint Scalp & Hair Strengthening Oil. Nizoral Anti-Dandruff Shampoo and Samnyte Hair Wax Stick maintained their spots at the top of the list. New to the list this quarter was L’Oréal Paris Excellence Creme Permanent Hair Color, Tea Tree Special Shampoo, and Color Wow Dream Coat Supernatural Spray.

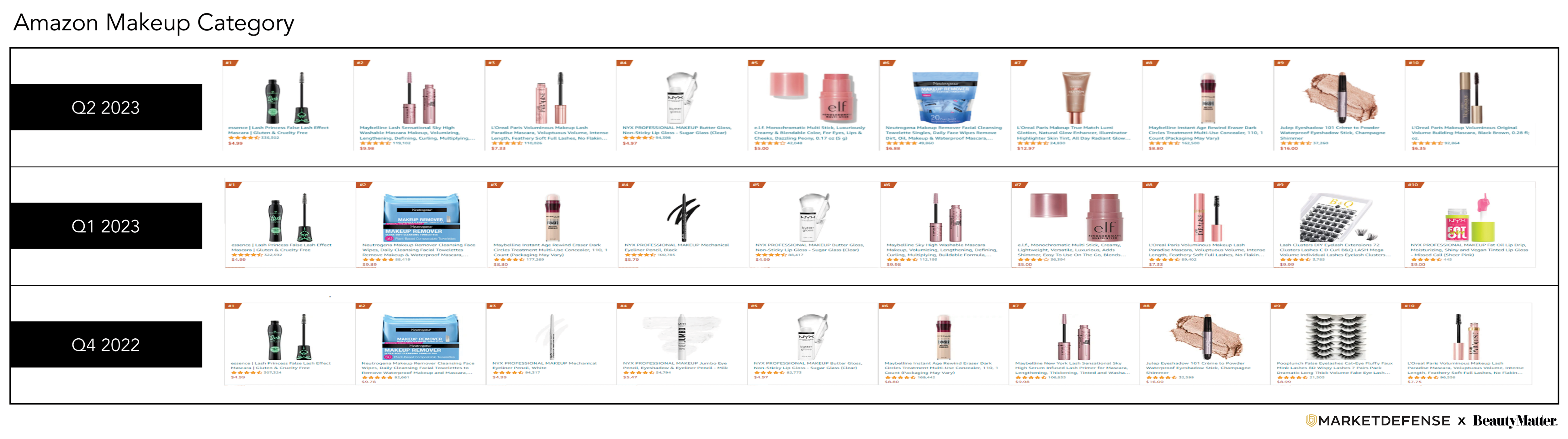

The Makeup Top 10 was consistent with previous quarters, highlighting favorites from Essence, Maybelline, NYX, Neutrogena, and L’Oréal. Once again, the average price point of the Makeup Top 10 was well below that of skincare and haircare at just $8.33, about 23% below the Top 25 List average during Q2 of $10.78.

With so much focus on price inclusivity in beauty, the question remains, “How can premium brands compete on Amazon with so many lower-priced competitors?” Is there room on Amazon for luxury beauty products? The answer, of course, is yes, but according to Vanessa Kuykendall, COO of Amazon agency Market Defense, there are a number of tactics premium brands must employ to find success, including:

Kuykendall added, “Success on Amazon as a luxury brand requires a meticulous balance between maintaining perceived exclusivity and leveraging the platform's wide customer reach. It's essential to align your online presence on Amazon with your overall luxury brand strategy to create a cohesive and premium shopping experience for your customers.”

Previous Reports:

Q1 2023 Amazon Top 25 Beauty & Personal Care

Q4 2022 Amazon Top 25 Beauty & Personal Care